Bank Relationship Management Service

SUCCESSFULLY NAVIGATING THE BANKING MAZE

Banks have complex organizational structures. For the corporation, that complexity is amplified by the number of banks it does business with. Add international locations and mergers & acquisitions to the mix, and treasury faces a labyrinth of accounts, creditor obligations, and connectivity challenges. If you’re not a full-time banking professional, the information you need – and the functional areas you must reach for resolution – can remain hidden within a fog of organizational complexity impossible for outsiders to decipher.

Actualize Consulting serves as the “outsider’s insider,” helping clients navigate their maze of banking relationships to address core questions such as:

Actualize Consulting serves as the “outsider’s insider,” helping clients navigate their maze of banking relationships to address core questions such as:

|

› Which banking products and services are required for your business needs, are worth pursuing, and with whom?

› Where should banking relationships be managed – centrally or locally? › Who do you call to resolve immediate problems such as transaction delays or account balances or long-term concerns like project delays, rates, terms or connectivity? › How do you objectively measure, compare, and assess the relative value of your bank relationships? › What’s the optimal way to manage wallet share and minimize risk? › How reasonable are your bank fees? |

REPLACE CONFUSION WITH CLARITY

|

Actualize Consulting provides the expertise and experience necessary to help you get the most value from your banking relationships, including:

› Negotiating transition service agreements (TSAs) that will minimize risks and enable optimal resource allocation when spinning off businesses

› Reviewing existing policies for opening and maintaining bank accounts to ensure cash balance transparency › Developing strategies and controls for user access to bank portals to minimize expenses › Creating bank service integration/segregation plans to support mergers & acquisitions, divestiture and spinoff activities in order to optimize resources and ensure bank partnership accountability › Weighing new bank offerings/services against commitments and the desire to remain bank-agnostic › Providing guidance on negotiating fees to minimize costs › Evaluating services and technology to enhance automation |

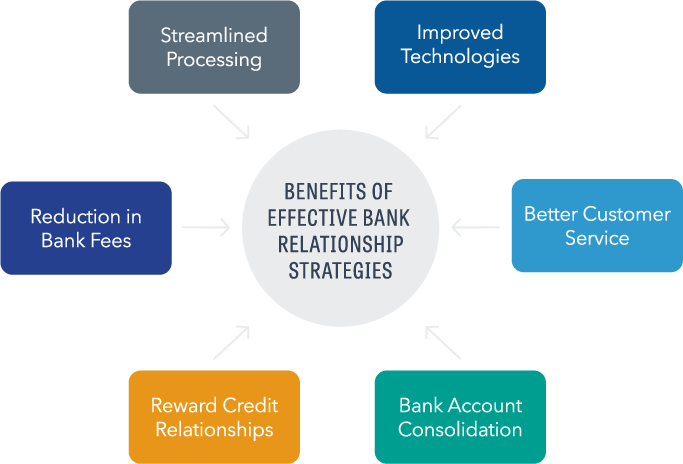

You can get more value from your banks…IF you manage your relationships strategically.

|