Payments Strategy Assessment

REDUCE COSTS AND RISKS WITH AN OPTIMIZED PAYMENT STRATEGY

|

Expected to do more with less, the contemporary Treasury must distill multiple obligations, banks, geographic regions, technology platforms, and connectivity protocols into ONE standardized payments strategy for the entire organization.

The pull of ever-changing regulations and the push for finding new efficiencies increase complexity where simplicity is desired. And the stakes are high: fulfilled correctly, an effective payments strategy can reduce costs, errors, and risks. But sub-optimal processes can create exposure to financial losses, regulatory non-compliance, and reputational damage. Actualize Consulting brings the expertise necessary for implementing an organization-wide payment strategy that delivers the efficiencies you want while minimizing the risks you need to avoid. BENEFITS AT A GLANCE› Real-time visibility and insights into your payment flows

› Opportunities for cost reduction and/or cash optimization › Sustained awareness of emerging payment standards, regulations, and legislation › Greater strategic alignment with banks, payment service providers, and other stakeholders › Reduced exposure to noncompliance and associated reputational risk › Improved security, reduced risk of cybercrime and fraud |

ACTUALIZE ASSESSES, DESIGNS, AND MONITORS YOUR PAYMENTS STRATEGY

Our team of experts brings years of payments experience to bear on your strategy, leading you through every aspect of payments success, including:

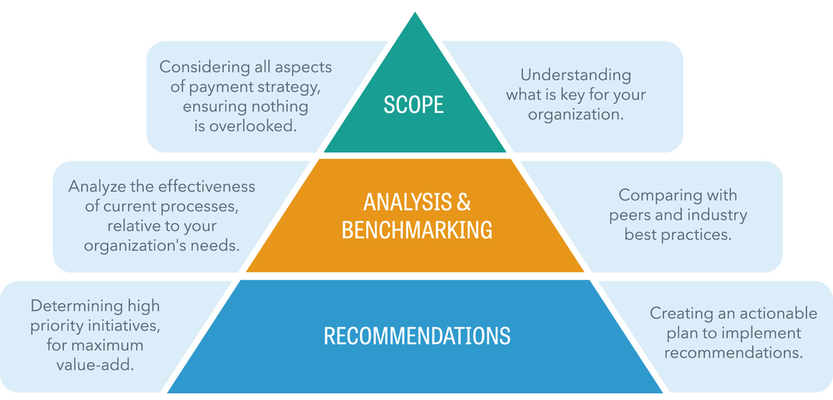

Actualize applies a proven process for establishing a payment strategy customized to your unique needs.

|

Assessment

We conduct a thorough assessment of all your payment activities and stakeholder obligations, from cut-off times and processing workflows to compliance and technology requirements. Benchmarking Actualize will benchmark your payment strategy status against industry peers and best practices. Solution Building Actualize produces a set of customized recommendations for progress that account for your banking relationships, IT platforms, vendor needs, and regulatory standards. |

Roadmap Design

The Actualize team creates a realistic path forward that allows you to reach the goals you establish with the resources available. Sustained Monitoring Regulations and standards are continually changing; Actualize keeps your organization up to date with new payment regulations and evolving standards that may impact your strategy. Stay Current Leverage Actualize industry insights to keep pace with the latest market offerings and new technology solutions. |