Treasury Assessment: People, Process and Technology

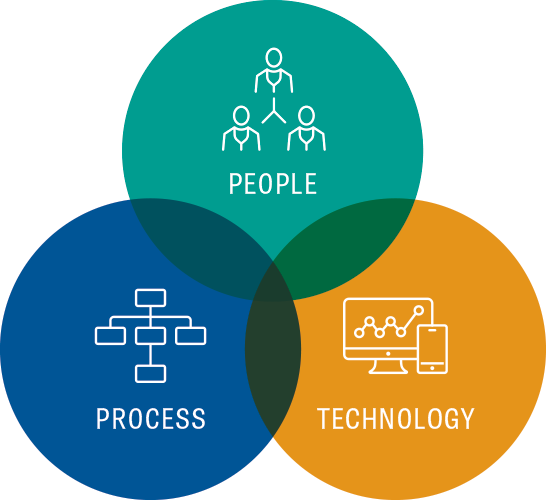

As the arbiters of all things cash related, treasury plays a crucial role in any organization’s ability to fulfill its purpose, its mission, and its strategy. To be an effective contributor, however, treasury should be something more than a functional slot between accounting and finance – it must have the people, processes, and technology in place to establish controls, segregate duties, standardize processes, and apply technology for effective treasury management.

ENSURING STANDARDIZATION AND EFFICIENCY THROUGHOUT TREASURY

Actualize Consulting uses a three-pillar strategy focusing on people, processes, and technology to apply best practice solutions to complex treasury challenges. These pillars are based on twenty years of consulting experience.

Working from the ground up in your organization, Actualize Consulting will ensure you have the right controls and processes in place to satisfy audit requirements, achieve regulatory compliance, and apply corporate standards across the enterprise. In addition to reviewing policies, we recommend steps to achieve consistency among key activities in cash and risk management, cash visibility, forecasting, debt, and investments. We review your organizational structure to ensure efficiencies and segregation of duties, proposing appropriate resource allocation and optimization of roles and responsibilities, including the training necessary to support new protocols. Finally, we review your technology footprint and recommend enhancements to enable timely data access and distribution.

Working from the ground up in your organization, Actualize Consulting will ensure you have the right controls and processes in place to satisfy audit requirements, achieve regulatory compliance, and apply corporate standards across the enterprise. In addition to reviewing policies, we recommend steps to achieve consistency among key activities in cash and risk management, cash visibility, forecasting, debt, and investments. We review your organizational structure to ensure efficiencies and segregation of duties, proposing appropriate resource allocation and optimization of roles and responsibilities, including the training necessary to support new protocols. Finally, we review your technology footprint and recommend enhancements to enable timely data access and distribution.

Assessing PeopleYour treasury resources not only fulfill specific functions that require special expertise, they also serve as the intersections among your internal functions and your key external relationships with banks, lenders, and partners. We review your organizational structure to ensure your ability to:

› Obtain and sustain the skill sets necessary for core Treasury activities › Define and manage roles and responsibilities that align with industry best practices › Balance centralized corporate oversight with local expertise necessary for operating in multiple national and global regions › Define a staffing structure appropriate to your corporate size, complexity, and process needs |

Assessing Processes

With extensive experience across numerous industries and locations worldwide, Actualize Consulting is well positioned to evaluate your processes against best-in-class industry practices, making recommendations to ensure your processes support your strategic goals effectively and efficiently. Functional areas under review include:

› Bank Relationship Management to ensure you receive the most value from your banking partners

› Cash Forecasting and Liquidity Management that is timely, accurate, and optimizes cash balances

› Debt and Investments and the most streamlined ways to manage both

› Foreign Exchange for corporate consistency, accuracy, and optimal operations

› Hedging and Risk Management with greater visibility to exposure and control

› Payments Processes that are secure, timely, and transparent

› Management Reports and KPIs consistent with your unique needs, structures, and goals

› Compliance that meets internal and regulatory commitments without burdening Treasury with excess manual effort

› Bank Relationship Management to ensure you receive the most value from your banking partners

› Cash Forecasting and Liquidity Management that is timely, accurate, and optimizes cash balances

› Debt and Investments and the most streamlined ways to manage both

› Foreign Exchange for corporate consistency, accuracy, and optimal operations

› Hedging and Risk Management with greater visibility to exposure and control

› Payments Processes that are secure, timely, and transparent

› Management Reports and KPIs consistent with your unique needs, structures, and goals

› Compliance that meets internal and regulatory commitments without burdening Treasury with excess manual effort

Assessing Technology

Technology is the third piece of the assessment – and the one that, properly implemented, enables the other two, your people and processes. We review your technology tools and platform with a focus on:

› Technology stack alignment with modern tools and coverage across all key functions

› Data and system integrations that enable rapid data sourcing, analytics, and report distribution across your enterprise

› Tools and their users to see if you have the tools you need – and people are adequately trained to use them

› Gap analyses of your existing architecture and capabilities to identify potential technology enhancements

› Applying automation to reduce or eliminate time-consuming manual labor and potential control risks

› Technology stack alignment with modern tools and coverage across all key functions

› Data and system integrations that enable rapid data sourcing, analytics, and report distribution across your enterprise

› Tools and their users to see if you have the tools you need – and people are adequately trained to use them

› Gap analyses of your existing architecture and capabilities to identify potential technology enhancements

› Applying automation to reduce or eliminate time-consuming manual labor and potential control risks

INFORMED BY THE BEST, CUSTOMIZED TO YOU

Actualize Consulting pursues a three-part strategy allowing us to analyze your situation in light of best industry practices while making recommendations tailored to your unique circumstances. Our approach includes:

|

1 |

|

Reviewing the current status of your people, processes, and technology to expose gaps and reveal productivity enhancements

|

|

2 |

|

Creating a vision for standardized, more efficient management of Treasury operations

|

|

3 |

|

Designing a pathway, including technology recommendations, to help you move from your current state to desired outcomes

|