Supply Chain Finance Program

|

Vendor payment obligations often constrain financial flexibility. But you can access more working capital – if you optimize the way you plan, prioritize, and negotiate your supply chain payment terms. By combining the right banking relationships, technology and vendor communications, an appropriate Supply Chain Finance program can provide the cash availability and payment terms flexibility you need to improve your working capital position while satisfying your obligations.

Unfortunately, disparate bank products, technologies, and even suppliers can create confusion where clarity is key. Actualize Consulting Supply Chain Finance Advisory creates a customized plan built upon the technology you need, a cost-efficient banking structure, and a vendor education plan that supports and even increases supplier adoption. |

MORE FLEXIBILITY FOR YOU, MORE OPPORTUNITIES FOR YOUR VENDORS

Supply Chain Finance Optimization benefits all parties at the table. With the right program in place, your organization enjoys new avenues for pursuing discounts and negotiating payment terms, while your participating suppliers appreciate reliable cash flows – and can leverage your excellent credit rating to access capital earlier at more advantageous rates.

BENEFITS AT A GLANCE

|

Your organization gains:

› Opportunities to negotiate discounts, free-up cash › Reduced risk of supply chain disruption › Greater flexibility via extended payment terms › Enhanced partnership with suppliers |

Your suppliers gain:

› Reduced day sales outstanding (DSO) › Opportunities to leverage your credit rating for better financing terms › Increased visibility for better cash flow prediction |

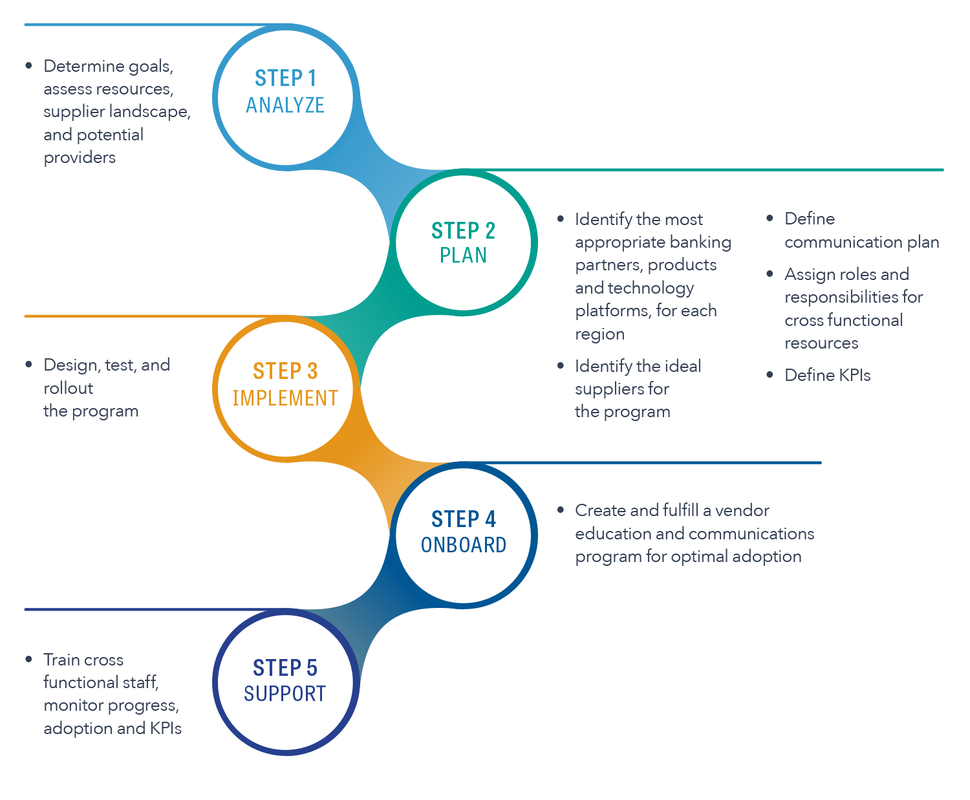

HOW SUPPLY CHAIN FINANCE WORKS

With variations in banking products, and regional regulations, establishing Supply Chain Finance – especially in global, multinational contexts – can be a daunting task for even the most sophisticated operations.

Actualize Consulting has the experience, expertise, and established relationships with technology and banking providers to design and fulfill Supply Chain Finance in less time with greater supplier buy-in.

Actualize Consulting has the experience, expertise, and established relationships with technology and banking providers to design and fulfill Supply Chain Finance in less time with greater supplier buy-in.