Creating a Digital Treasury Function

Digital transformation is the key to thriving in the next decade. Emerging technologies are changing how we do business – these include The Cloud, Robotic Process Automation (RPA), Artificial Intelligence (AI), Business Intelligence (BI), and Blockchain. The increasingly connected ecosystem that these technologies provide can be leveraged in Treasury to enhance visibility and deliver more informed decision making - something many are now calling Treasury 4.0, a fully digital Treasury function.

Why Start Now?

- The business world has changed drastically over the last decade – being digitally connected is more important than ever.

- Treasury’s role continues to evolve - 85% of Treasuries now describe their team as a “value adding service centre.” A digital Treasury function will allow your team to focus on the value adding tasks with less distraction, providing strategic insights for your organisation.

- Having more data at your fingertips in and in view means less risk for your organisation.

- Embarking on the digital transformation journey will help relieve workload issues caused by repetitive tasks.

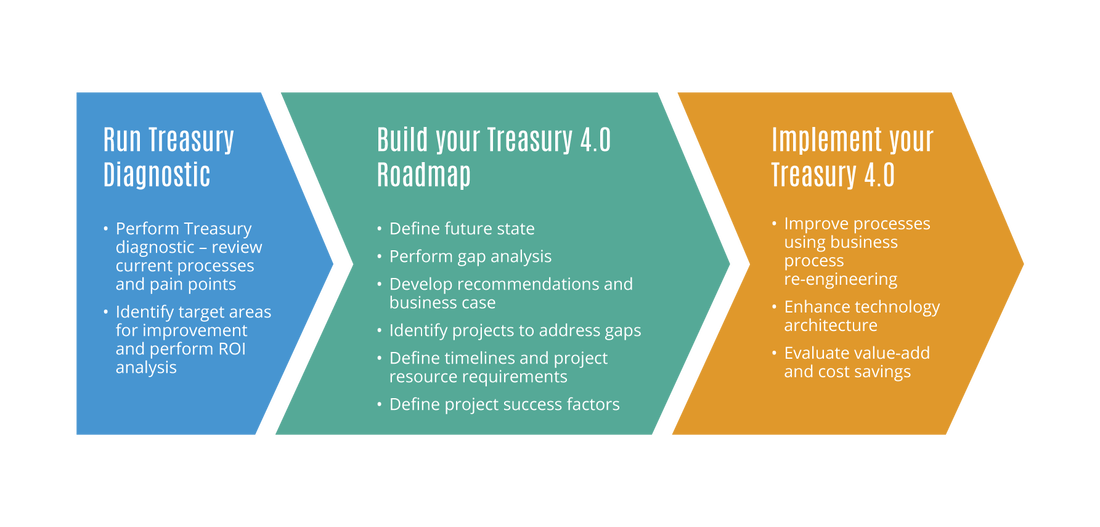

Our Proposed Approach

Actualize can support your transition to Treasury 4.0 by helping your Treasury run existing processes smarter and leaner in the short-term while preparing for deeper architectural changes in the medium-to long-term.

The Enabling Technologies

These are some of the key technology trends of this decade and how we believe they can help you on your journey to a truly digital treasury function.

- Cloud: The Cloud (or Cloud Computing) is the on-demand availability of computer system resources, usually data storage and computing, powered over the Internet. Treasury departments have been traditionally underserved by their IT departments, so not only has utilizing cloud applications reduced Treasury’s reliance on this department, it has also significantly reduced overall cost. Storing your data in the cloud or making use of systems powered by the cloud makes data more accessible as well. A laptop or mobile can be used to view cash positions, approve payments, and run reports from anywhere - all you need is the internet.

- Actualize Consulting has a proven track record of successfully delivering cloud powered systems covering all key treasury processes. We help define your future state cloud-based architecture and assist in the selection and implementation of these systems ensuring you obtain maximum value.

- Our consultants have intimate knowledge of treasury management systems (TMS), payment solutions, cash forecasting systems, and other fully cloud enabled applications coupled with a proprietary methodology to successfully implement these solutions.

- Robotic Process Automation (RPA): RPA software is used to automate business processes governed by business logic and structured input. The software can be configured like a “robot” to capture and interpret applications for manipulating data, processing transactions, triggering responses, and communicating with other digital systems. RPA can be used as “bridge” technology - helping Treasuries overcome legacy system constraints until they are ready to fully migrate to newer technologies. RPA reduces repetition and error for important Treasury tasks, freeing up time for higher value activities.

- Actualize Consulting will perform a Treasury diagnostic to identify opportunities for your Treasury to leverage RPA, carry out ROI analysis and deploy the resulting RPA solution.

- There are countless use cases for RPA including:

- Optimizing the cash visibility process (by automating daily cash reconciliation, bank balance reporting, and other parts of the cash management process)

- Automating the FX process (by aggregating requests, initiating pricing requests and executing trades); and

- Automating management reporting.

- Business Intelligence (BI): Business intelligence consists of the strategies and technologies used for examining business information – including historical, current and predictive analysis. As the role of Treasury continues to evolve into a value centre with crucial input into organisation-wide strategies, it is necessary to have tools in place that present real-time data in a meaningful way that enables more informed decision making.

- At Actualize, we can harness the power of BI to facilitate real-time financial and management reporting with dynamic dashboards. This allows you to view and consume information that might otherwise be difficult to get or time consuming to compile from your current systems (TMS, ERP, Payment systems and trading systems, etc.) and provides valuable insights to make better and more timely decisions.

- Artificial intelligence (AI): In the simplest sense, AI is the creation of “intelligent” machines that try to work and react like humans would. Similar to humans, the more they know, the better they perform… and they get better with experience over time. Cashflow forecasting remains top of the agenda in Treasury and AI can dramatically enhance the accuracy of forecasts. Employing AI and analytics enables behavioral forecasting tools that ‘learn’ to forecast more accurately as they accumulate data on historical patterns and take many real-world variables into account.

- At Actualize, we assist our clients in identifying and delivering tools that best utilize AI to deliver enhanced insights and automation into predictive functions such as forecasting and working capital management.