Actualizing Current Market Trends

On this page you will find various papers to address current markets trends.

MANAGING INTERCOMPANY TRANSACTIONSIn treasury management, the term intercompany refers to financial transactions or activities that occur between different entities within the same corporate group. These transactions can include intercompany loans, transfers of funds, investments, trades (sales of service or products), or any other financial arrangements between subsidiaries, parent companies, or sister companies within the same corporate structure.

|

MANAGING CASH WITH EFFECTIVE LIQUIDITY PLANNINGTreasurers are tasked with providing enough capital for operations and expenses while minimizing borrowing expenses, maximizing investment returns, and reducing financial risks. Effective liquidity management is essential to mitigate financial risks such as unexpected cash flow fluctuations or liquidity issues while efficiently managing cash and debt balances.

|

TREASURY PAYMENTS RISK MANAGEMENTHistorically, risk management in payments focused primarily on ensuring accuracy and maintaining operational continuity. While these remain pertinent factors, organizations must also recognize that the landscape has evolved with new risks from the rise of digital transactions, increased cyber threats, and more complex global payments. A recent survey by the Association for Financial Professionals estimates that 65% of organizations were victims of payment fraud attacks or attempts last year and that almost half of those affected were unable to recoup lost funds.

|

USING TECHNOLOGY TO ADVANCE TREASURY OPERATIONSTechnology increases the opportunity for treasury centralization, standardization and enables treasurers to demonstrate control over activities and perform tasks more effectively. Software companies continue to innovate and deploy SaaS technology that helps automate and simplify the various processes corporate treasury supports. Automation streamlines processes, improves accuracy and traceability in calculations and provides a more transparent and up-to-date view of the company’s financial situation. We see the benefits companies reap from leveraging Treasury Management Systems (TMS) and other software to manage liquidity and risk functions. Additionally, the use of APIs and AI have brought forth more capabilities, such as real-time access to key data across organizations and financial institutions and analytics that until now were difficult to develop with existing tools.

|

HOW TO RETAIN TREASURY TALENTTalent retention is a universal goal for any firm. Retention is especially vital to a successful Treasury team as the talent pool is not as deep as other industries, while the breadth of unique knowledge and experience required is extensive. We are seeing turnover at all levels within Treasury teams, from senior management to the analyst level, and experienced Treasury professionals are always in demand. When Actualize Consulting works with Treasury departments, we share our experiences to reduce employee turnover and retain top talent.

|

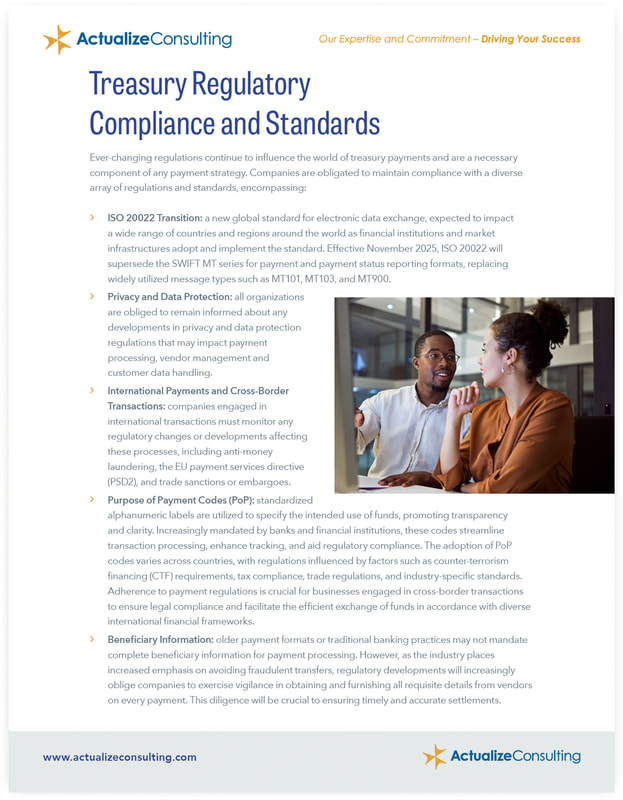

ISO 20022 ADOPTIONFor corporates these days executing a holistic payments strategy can feel like a never ending project in itself. Beyond the considerations of strategic banking partners, introduction of new API functionality, execution of fraud and sanction screening, it seems nothing remains the same for long. Perhaps the most significant of all recent developments is the ongoing adoption of a (some would say long awaited…) global standard for exchanging financial information – referred to as ISO 20022.

|

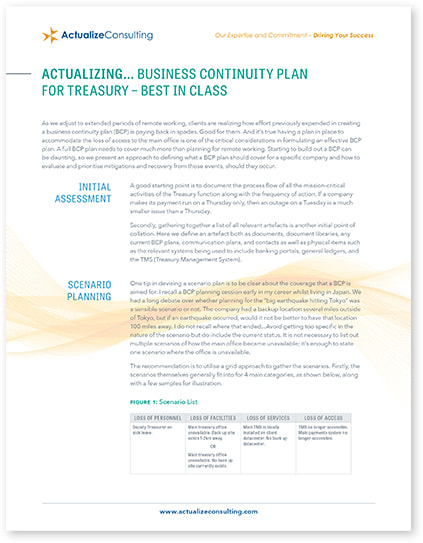

BUSINESS CONTINUITY PLAN FOR TREASURY – BEST IN CLASSAs we adjust to extended periods of remote working, clients are realizing how effort previously expended in creating a business continuity plan (BCP) is paying back in spades. Good for them. And it’s true having a plan in place to accommodate the loss of access to the main office is one of the critical considerations in formulating an effective BCP plan. A full BCP plan needs to cover much more than planning for remote working. Starting to build out a BCP can be daunting, so we present an approach to defining what a BCP plan should cover for a specific company and how to evaluate and prioritize mitigations and recovery from those events, should they occur. Click here or the button below to download the PDF.

|

COLLABORATION TOOLS TO AID IN REMOTE WORKINGDue to current circumstances, many organizations have found themselves venturing into the new space of remote working. While most companies have their existing suite of collaboration tools to enable flexibility on location, it might not be enough infrastructure to ease the growing pains of a full work-from-home transition. At Actualize, we were an early adopter of Cloud Technology to support our internal team that has worked remotely for over 15 years, so we were prepared and seasoned for this shift. Using our experience through the years, these are the things we have found helpful to work remotely, efficiently, and with sufficient controls in place. As we have discovered, working remotely does not mean you have to sacrifice collaboration for flexibility; you just need to be a bit more creative. Click here or the button below to download the PDF.

|

LIBOR TRANSITIONThe LIBOR transition date of June 2021 is now less than a year away. Almost every conference has a session on the topic and at Actualize we see a marked increase in the request for information and advice from our clients. In this overview we explain the issue at hand, why there is a meaningful financial impact looming, and an outline for how to get practically started with an all-encompassing transition plan. Click here or the button below to download the PDF.

|