MERS®

|

Actualize Consulting provides a cost-effective solution to meet MERS® requirements.

Actualize Consulting is a designated MERS® Quality Assurance Vendor. Our team has extensive experience in providing MERS® related business and technical services to the financial services industry. We work with our clients on: › MERS® Annual third-party Attestation › Development of MERS® policies, procedures, and controls › MERS® quality control reviews |

MERS® ANNUAL THIRD-PARTY ATTESTATION:

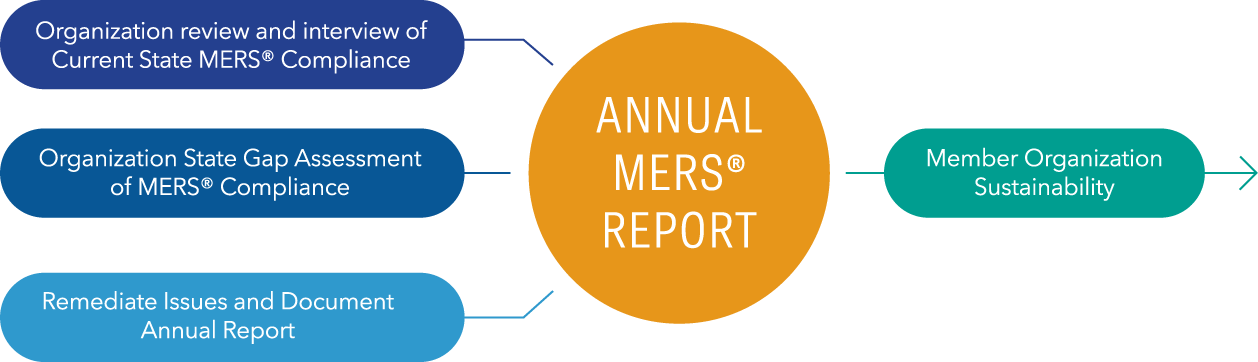

Actualize Consulting’s approach to your annual MERS® compliance is a consultative partnership, versus a point in time audit. We invest the time to build partnerships with companies to ensure the right policies and procedures are in place to fit individual MERS® data and quality assurance standards.

Actualize Consulting’s team conducts a review of your policies, procedures, controls, and practices in place to validate compliance with the MERS® Membership Agreement requirement. We create the final summaries of findings and impart best practices, as well as changes that may need to be implemented.

Actualize Consulting’s team conducts a review of your policies, procedures, controls, and practices in place to validate compliance with the MERS® Membership Agreement requirement. We create the final summaries of findings and impart best practices, as well as changes that may need to be implemented.

Actualize Consulting offers:

› Precise, repeatable audit procedures that allows us to drive down the fee schedule for completing the MERS® Annual Report.

› Inclusion of a remediation roadmap that allows our clients to remedy any gaps between their current state and the MERS® requirements.

› Ability to provide automated, cost-effective data reconciliation/correction, should that service be required.

› Precise, repeatable audit procedures that allows us to drive down the fee schedule for completing the MERS® Annual Report.

› Inclusion of a remediation roadmap that allows our clients to remedy any gaps between their current state and the MERS® requirements.

› Ability to provide automated, cost-effective data reconciliation/correction, should that service be required.

|

Deliverables:

› An in-depth management report including any exceptions relative to MERS® requirements as well as a gap analysis, observations, recommendations, and a roadmap to remediating the identified exceptions/gaps. We base our findings and recommendations on MERS® requirements as well as our expert understanding of industry leading practices. › Sign-off on the MERS® Annual Report. |

Follow-on Remediation Engagement:

› The Actualize team is prepared to assist in remediating any exceptions that are noted in the MERS® Annual Report.

|

DEVELOPING YOUR MERS® PROGRAM

Whether new to MERS® or looking to remediate a deficiency, Actualize can help ensure you are building the right program for your business. We understand the mortgage business and use our expertise to develop a customized MERS® Program that works best for your company and staff.

Deliverables:

› Provide initial validation of entire portfolio. With our tools and techniques, we can quickly match the MERS® data to the source system to gage the level of clean-up, correction, and process to effectively manage the monthly task.

› Develop policies and procedures, operating controls, existing transaction reporting, reconciliation and, exception management processes relating to and in accordance with MERS® Quality Assurance Standards.

› If using Subservicers we will work to ensure they are sending the correct information, adhere to MERS® requirements and determine a Quality Assurance plan to ensure MERS® requirements are being followed.

› Provide recommendation on Process automation, tools, or outsourcing for on-going support and validation.

› Provide custom templates designed for documenting and following MERS® requirements.

› Provide custom training to your MERS® team to ensure your staff has what they need to complete the required tasks.

› Provide initial validation of entire portfolio. With our tools and techniques, we can quickly match the MERS® data to the source system to gage the level of clean-up, correction, and process to effectively manage the monthly task.

› Develop policies and procedures, operating controls, existing transaction reporting, reconciliation and, exception management processes relating to and in accordance with MERS® Quality Assurance Standards.

› If using Subservicers we will work to ensure they are sending the correct information, adhere to MERS® requirements and determine a Quality Assurance plan to ensure MERS® requirements are being followed.

› Provide recommendation on Process automation, tools, or outsourcing for on-going support and validation.

› Provide custom templates designed for documenting and following MERS® requirements.

› Provide custom training to your MERS® team to ensure your staff has what they need to complete the required tasks.

MERS® QUALITY CONTROL REVIEWS

Actualize Consulting provides accurate, efficient, and cost-effective MERS® data validation. Using automated tools, we can validate data across the Source System and Loan documents to ensure your data meets MERS® Quality Control Requirements. Actualize services include:

|

› Loan Document reviews: MERS® requires specific fields to be accurately represented within a user’s system. Actualize has experienced employees who know what MERS® requires for each document and can quickly validate a large population.

|

› Borrower & Address Data Validation: Determining if your data is the same as it appears on a document can be difficult when you have +1,000 MIN in your portfolio. Actualize Consulting has created an automated process to validate that what you have in your documents accurately portrays what is in MERS® and your source system.

|

› System to System Reconciliation: Automated tools that can quickly identify discrepancies and help identify the proper remediation between MERS® and your source system.

|

For any questions – please contact John Pomaranski – [email protected]

Learn more about Preparing for a Successful MERS® Audit